Carronade Shares Perspectives on Viasat

Carronade Supports Spin-Off or IPO of the Defense and Advanced Technologies Business

Potential 215% to 520% Upside in the Stock if Company Completes a Separation

Defense and Advanced Technologies is Worth $50/share Alone

DARIEN, Conn., July 31, 2025 (GLOBE NEWSWIRE) -- Carronade Capital Management, LP on behalf of its managed entities (“Carronade Capital”, “our” or “we”), have beneficial ownership of approximately 2.6% of the outstanding shares of Viasat, Inc., (NASDAQ: VSAT) (“Viasat” or the “Company”) today issued the following open letter outlining its perspective on Viasat’s ongoing strategic review and offering a clear and effective way to unlock the substantial, unrealized value embedded within the Company.

Carronade’s letter underscores a compelling case for separating the undervalued and underappreciated Defense and Advanced Technologies (“DAT”) segment, which could be one of the most attractive pure-play defense-technology platforms in the market today, with best-in-class margins, double-digit revenue growth and significant exposure to next-gen defense technologies. Carronade believes a successful execution of a DAT separation would crystallize value for shareholders, empower both DAT and Communications Services segments to chart focused, capital-efficient growth strategies and bolster financial flexibility to drive the share price up to $100 per share. Carronade believes the remaining Communications Services segment would have less debt and be positioned for free cash flow generation.

Carronade urges Viasat’s Board and management team to prioritize a DAT spin as the key outcome of the ongoing strategic review and believes it would garner strong investor support.

The full letter follows:

Carronade Capital Management, LP on behalf of its managed entities (“Carronade Capital,” “our,” or “we”) have beneficial ownership of approximately 2.6% of the outstanding shares of Viasat, Inc., (“Viasat” or the “Company”), making us one of Viasat’s top investors. We have been investors in Viasat since 2023 and are long-term believers in the Company’s mission, the strength of its leadership team, and the extraordinary strategic position the Company holds at the intersection of secure communications, global connectivity, and aerospace and defense technology.

Today, we wanted to share our view that the current valuation of Viasat fails to reflect the value of its most important asset — the Defense and Advanced Technologies (“DAT”) business. We believe that the time has come to separate this crown jewel through a spin-off or IPO, a step which we believe should unlock tremendous value and can result in the pre-event Viasat shares trading at a range of ~$50 to $100+ per share. With the strategic review process already underway, we believe this is the clearest, most effective way to unlock the substantial, unrealized value embedded within the Company.

Highlight A Premier High-Growth Aerospace and Defense Tech Platform

The case for separation is compelling. In our view, the DAT segment could be one of the most attractive standalone defense-technology platforms in the public markets today. With best-in-class margins, double-digit revenue growth, and significant exposure to next-generation defense and dual-use technologies, DAT is already delivering on a vision to which many public and private peers can only aspire.

Excluding the non-recurring contribution from the litigation settlement in Q2 FY2024, as reported revenue within DAT grew almost 17% in the last 12 months, with LTM EBITDA margins of 28%. Demonstrating the continued rapid trajectory of this business, the Company reported in Q4 FY2025 that the backlog within DAT grew 50% year over year with a book-to-bill of 1.2x. These figures also screen extremely well under the “Rule of 40”, combining profitability with robust growth, and we strongly believe the business would be rewarded accordingly on a standalone basis.

We believe DAT’s business lines span critical and rapidly growing areas. This is further enhanced by market share gains, driving growth that continues to exceed overall TAM growth. DAT has the potential to benefit across the following new initiatives and new technologies:

-

Golden Dome – falls under Tactical Networking and Space & Mission Systems within DAT (providing encrypted mesh networking, battle management systems, ISR integration)

- DAT’s tactical networking and secure communications systems are highly applicable to layered air and missile defense systems such as the Golden Dome. Its encrypted mesh networks and ISR data links can help integrate interceptors, radars, and command nodes in contested environment

-

Next-Generation Encryption – part of Information Security & Cyber Defense, a core DAT unit

- Develops advanced, Type 1-certified encryption for high-assurance military communications. As defense agencies adopt edge-resilient encryption, we believe DAT stands to benefit from long-cycle upgrades across satellites, tactical radios, and classified networks

-

Drones (UAVs and UAS) – spans Tactical Networking and Space & Mission Systems

- Anti-jam networking solutions for a wide range of unmanned aerial systems. As demand accelerates for autonomous ISR and strike platforms, we believe DAT is well positioned to scale its footprint across drone technology

-

Direct-to-Device (D2D) – supported by both Advanced Technology & Other and Space & Mission Systems

- DAT is advancing D2D capabilities through both government waveform programs and a commercial joint initiative with UAE-based Space42, focused on developing a global, 3GPP-compliant multi-orbit NTN platform designed to enable future connectivity directly to unmodified smartphones and IoT devices using licensed L-band and S-band spectrum

-

Low Earth Orbit (LEO) – squarely in Space & Mission Systems

- The Space & Mission Systems team provides space-qualified hardware, optical inter-satellite links, and advanced ground integration tools that support LEO network resilience. As multi-orbit architectures gain traction, they benefit from integration roles across both government and commercial constellations

The above are all long-cycle, durable growth markets with deep commercial and government demand, and we believe DAT is already winning. Yet despite this backdrop, from our perspective the market is barely valuing DAT at all — its performance is being obscured by broader investor concerns with respect to Communication Services, as evidenced by a nearly 20% short interest in the stock.

Carronade’s Analysis Supports $50 - $100+ per Share Valuation

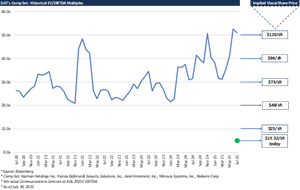

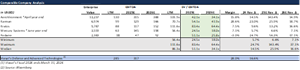

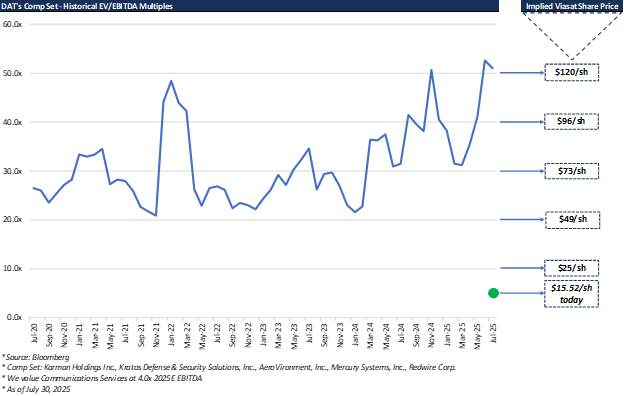

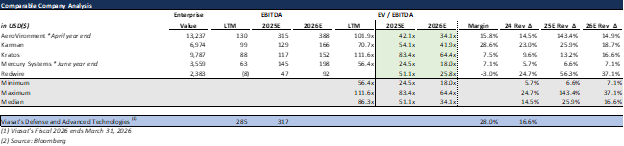

This disconnect is further underscored by the current valuation environment for DAT’s aerospace and defense peers. Mid-cap defense-technology companies such as Kratos Defense & Security Solutions, AeroVironment, Karman Holdings, Redwire, and Mercury Systems (“Comp Set”) have historically traded between 20x-40x EV/EBITDA, and in many cases are significantly higher today, as public investors seek exposure to the growth in the aerospace and defense industry. By contrast, the market appears to be pricing Viasat as a structurally challenged communications conglomerate. We believe this framing fails to recognize both the profitability and the growth trajectory of DAT.

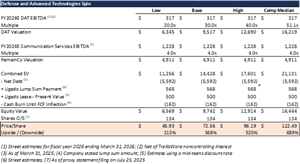

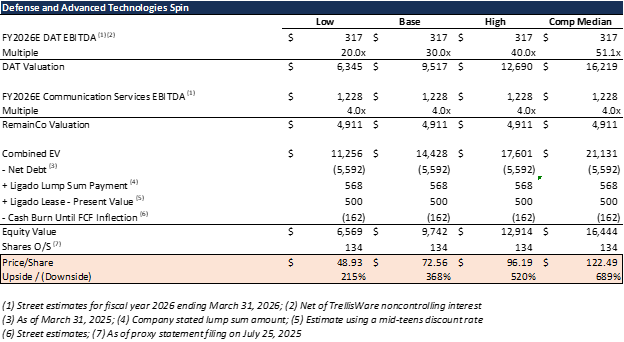

It is not an overstatement to say that from a value perspective, Viasat is an aerospace and defense tech focused company first, that also happens to be in the satellite communications business. Our analysis suggests, utilizing a 20% discount to the median 2025E EBITDA multiple of the DAT Comp Set, less overall net debt, a valuation of over $50/share – more than 3x the current stock price – excluding any value for the $1.3 billion EBITDA Communication Services business or the $8/share in value from the Ligado Networks settlement. In total, using the historical ranges for the DAT Comp Set and 4.0x1 on the Communication Services business, we believe the stock is worth between ~$50-$100/share, and well in excess of $100/share if DAT trades at the current median of the Comp Set.

While each peer has a distinct focus, they are all aerospace and defense technology companies that we believe are well positioned to benefit from similar tailwinds. Over the past five years, this Comp Set has generally traded at 20x to 40x EBITDA, with further multiple expansion seen in 2025. The chart below illustrates the implied Viasat share price after applying these historical ranges to DAT, alongside a fixed 4.0x multiple for Communication Services and our assumptions for the present value of the recent Ligado Networks settlement.

DAT’s implied size, revenue growth, leading margins, and exposure to the most exciting aerospace and defense themes, highlight the favorable comparability to the Comp Set as shown below. With 50% year over year backlog growth, strong book-to-bill, and new recent awards, we believe growth trends are supported into 2026 and beyond.

We believe the separation of DAT would not only catalyze a re-rating of that business but also deliver material benefits to the remaining company. Viasat could retain a portion of the spin-off for future monetization. If an IPO were pursued, proceeds could be used to de-lever the balance sheet, bolstering capital flexibility, while reducing financial risk. Moreover, the current stock price implies standalone valuation near the lows after adjusting for the approximately $8/share Ligado Networks settlement value that was unanticipated by most market participants. Finally, we believe separating DAT would allow both businesses to be valued on their own strategic and financial merits and create transparency into the dramatically different growth, TAMs, margin profiles, and capital requirements of each.

Resilient Global Communications Business

Carronade also believes the Communications Services segment is materially misunderstood by the market with competitors such as Starlink and Kuiper catalyzing a substantial amount of pessimism on the shares. We believe a separation will help shine a light on the positive trajectory of this business.

With five-to-ten year contract terms in the in-flight connectivity (“IFC”) business, this unit of Communication Services has approximately 1,600 additional commercial aircraft that will be put into service under existing customer agreements with commercial airlines over time, on top of the 4,120 currently in-service aircraft, representing 39% growth2. The durability of IFC growth, coupled with a high-growth government business and an inflecting maritime business, as evidenced by NexusWave recently exceeding 1,000 vessel orders3, in our view demonstrates the long-term viability of the core satellite business. Critically, in our view Communication Services is set to generate consistent positive free cash flow in the coming quarters, and more significantly, the long-term cash generation of the satellite business is set to inflect strongly after the successful deployment of the ViaSat-3 F2 and F3 satellites. According to a research report from Deutsche Bank on March 24th4, each new ViaSat-3 satellite has the potential to add 2 to 3 percentage points of growth to Communication Services revenue, while also shifting the revenue mix toward higher-margin, internally provisioned capacity and reducing reliance on low-margin wholesale sales. Once capital expenditures for the ViaSat-3 constellation are complete, we expect annual capex to decline to below $1 billion (from ~$1.3 billion in FY2026), creating substantial room for accelerated free cash flow generation and debt paydown.

Given all of the above, we believe our valuation of 4.0x on the Communication Services segment is conservative and unjustifiably below similar business valuations. SES, when accounting for the present value of 100MHz of possible C-band monetization, and pro forma for the Intelsat acquisition, trades at 4.25x-4.50x on the base business. Similarly, both Eutelsat and Iridium trade at high-single-digit EBITDA multiples5. In our view, the growth opportunities, end customers, and stickiness of contracts are significantly more attractive for Viasat’s Communication Services business.

As a result of the settlement with Ligado Networks, the Company is set to receive $568 million in fiscal year 2026, coupled with a lease stream through 2107 that increases 3% per year6 that is worth north of $500 million from a present value perspective, which positions it for further de-levering. The Company’s remaining spectrum portfolio offers substantial flexibility for future monetization to which we ascribe no value in this analysis. In our view, these dynamics are obscured in the current structure and would be far more visible in a standalone Communications Services business.

The Time to Act is Now

With strong commercial momentum across both segments, from NexusWave surpassing 1,000 vessel orders and sustained growth in in-flight connectivity for the Communication Services business, and a proven track record of growth and profitability within DAT, we believe Viasat is at a critical inflection point. In our view, the growth and profitability of DAT is only set to accelerate due to rapidly increasing investment within drone technology, direct-to-device, advanced encryption, Golden Dome, and LEO. Yet we are seeing that public markets continue to discount the stock due to a misplaced narrative. We believe executing a spin-off or IPO of DAT, the Company’s most valuable asset, would not only crystallize value for shareholders, it would empower both businesses to chart focused, capital-efficient growth strategies with improved investor visibility.

We applaud management exploring various paths to unlock portfolio value, drive returns and shareholder value, but urge them to consider our proposed path forward. We believe a spin-off or IPO of DAT would be met with broad investor support and would position Viasat to emerge as two distinct, category-leading companies: one a premier, high-growth aerospace and defense tech platform; the other a resilient, cash-generating global connectivity business while unlocking tremendous value resulting in ~$50 to $100+ per share.

About Carronade Capital

Carronade Capital Management, LP (“Carronade Capital Management”) is a multi-strategy investment firm based in Connecticut with approximately $2.5 billion in assets under management that focuses on process driven investments in catalyst-rich situations. Carronade Capital Management, founded in 2019 by industry veteran Dan Gropper, currently firm employs 14 team members and is based in Darien, Connecticut. Carronade Capital was launched on July 1, 2020. Dan Gropper brings with him nearly three decades of special situations credit experience serving in senior roles at distinguished investment firms, including Aurelius Capital Management, LP, Fortress Investment Group and Elliott Management Corporation.

Important Disclaimers

Not an Offer or Solicitation. This press release is for informational purposes only. It does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to any person.

Not Financial Advice. This press release does not recommend the purchase or sale of a security. There is no assurance or guarantee with respect to the prices at which any securities of Viasat, Inc. (the "Company") will trade, and such securities may not trade at prices that may be implied herein. In addition, this press release and the discussions and opinions herein are for general information only, and are not intended to provide financial, legal or investment advice. Each shareholder of the Company should conduct their own financial research and analysis and make a decision that aligns with their own financial interests, consulting with their own advisers, as necessary.

Forward-Looking Statements. This press release contains forward-looking statements. Forward-looking statements are statements that are not historical facts and may include projections and estimates and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services, product development and potential, and statements regarding future performance. Forward-looking statements are generally identified by the words "expects", "anticipates", "believes", "intends", "estimates", "plans", "will be" and similar expressions. Although Carronade Capital and its affiliates believe that the expectations reflected in forward-looking statements contained herein are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties—many of which are difficult to predict and are generally beyond the control of Carronade Capital or the Company—that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. In addition, the foregoing considerations and any other publicly stated risks and uncertainties should be read in conjunction with the risks and cautionary statements discussed or identified in the Company's public filings with the U.S. Securities and Exchange Commission, including those listed under "Risk Factors" in the Company's annual reports on Form 10-K and quarterly reports on Form 10-Q . The forward-looking statements speak only as of the date hereof and, other than as required by applicable law, Carronade Capital does not undertake any obligation to update or revise any forward-looking information or statements.

Data and Analysis. Certain information included in this press release is based on data obtained from sources considered to be reliable. Any analysis provided herein is intended to assist the reader in evaluating the matters described herein and maybe based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly, any analysis should not be viewed as factual and should not be relied upon as an accurate prediction of future results. Projected information presented herein is generated using an internal Carronade model and is therefore inherently limited. This information is generated based on certain estimates and assumptions which are subject to change based on prevailing market and economic conditions, as well as Carronade’s ongoing assessment of the Company. All figures are estimates and, unless required by law, are subject to revision without notice.

Holdings and Trading. Certain of the funds(s) and/or account(s) (“Accounts”) managed by Carronade Capital Management, LP (“Carronade Capital Management”) currently beneficially own shares of the Company. Carronade Capital Management in the business of trading (i.e., buying and selling) securities and intends to continue trading in the securities of the Company. You should assume the Accounts will from time to time sell all or a portion of its holdings of the Company in open market transactions or otherwise, buy additional shares (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls, swaps or other derivative instruments relating to such shares. Consequently, Carronade Capital Management's beneficial ownership of shares of, and/or economic interest in, the Company may vary over time depending on various factors, with or without regard to Carronade Capital Management's views of the Company's business, prospects, or valuation (including the market price of the Company's shares), including, without limitation, other investment opportunities available to Carronade Capital Management, concentration of positions in the portfolios managed by Carronade Capital Management, conditions in the securities markets, and general economic and industry conditions. Without limiting the generality of the foregoing, in the event of a change in the Company's share price on or following the date hereof, Carronade Capital Management may buy additional shares or sell all or a portion of its Account’s holdings of the Company (including, in each case, by trading in options, puts, calls, swaps, or other derivative instruments relating to the Company’s shares). Carronade Capital Management also reserves the right to change the opinions expressed herein and its intentions with respect to its investment in the Company, and to take any actions with respect to its investment in the Company as it may deem appropriate, and disclaims any obligation to notify the market or any other party of any such changes or actions, except as required by law.

Media Contact:

Paul Caminiti / Jacqueline Zuhse

Reevemark

(212) 433-4600

Carronade@reevemark.com

Investor Contacts:

Andy Taylor / Stas Futoransky

Carronade Capital Management, LP

(203) 485-0880

ir@carronade.com

1 Derived by using a discount to SES SA, Eutelsat Communications, and Iridium Communications as the peer set for Communications Services; for illustrative purposes only.

2 Viasat 2025 Annual Report

3 Viasat July 1, 2025 Press Release

4 Deutsche Bank report “Multiple Paths to Unlocking Value; Upgrade to Buy”

5 Source: Bloomberg

6 Viasat June 13, 2025 Press Release

Charts accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1b382282-b275-4da4-a882-c526b3387fc4

https://www.globenewswire.com/NewsRoom/AttachmentNg/710e4232-9a2e-4280-9767-20bd501b699a

https://www.globenewswire.com/NewsRoom/AttachmentNg/1786b60d-3b34-4f9e-8100-77a6b4c15b9a

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.